What’s The Easiest Way To Free Up Money In My Business?

How To Use Your Emotions As Your Financial Friends

What’s the problem we’re addressing?

Running a business is already tough enough without your emotions dragging your wallet into things. When unchecked, emotions can push you into reckless moves, lost deals, wasted time, and overspending that ruins your profits.

So what’s the solution?

Recognize this chain of how emotions can lead to bad and expensive decisions: Emotion → Sinful Action → Consequence.

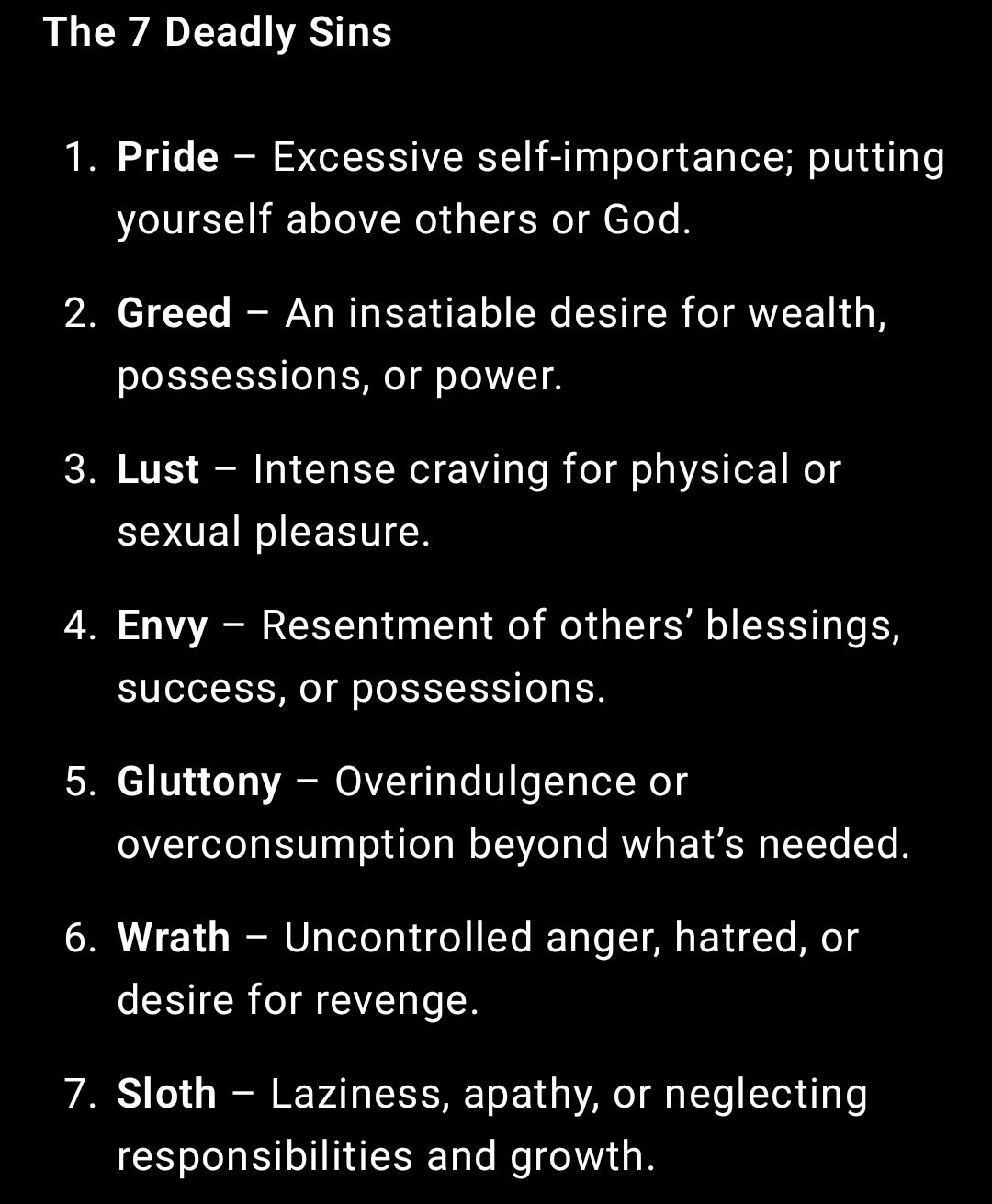

In short, situations make you feel emotions. Those emotions lead you to actions. And if your actions are dominated by one of the 7 deadly sins, it will eventually lead to negative results.

NOTE - this article is NOT speaking on religion at all. The 7 deadly sins outline just works very well for explaining how emotions can lead to unwanted consequences.

So if your business is seeing negative results, you need to spot the emotion behind your decisions. Then, you can stop yourself from reacting in ways that cost your business money.

By the end of this post, you’ll see how emotions sneak into your finances and leadership, and how to stop them before they drain your bank account or destroy your reputation.

Lesson 1: Your Business Fails from Reactions, Not Numbers

The hidden danger isn’t always competition, the stock market, social media, or the economy. It’s how you react when emotions flare up. Desire, fear, anger, insecurity, boredom, curiosity, and worry are all normal. But if you let them drive your decisions without thinking, new bills will start to show up fast.

Lesson 2: Every Emotion Ties to a Sinful Action (and a Bill You’ll Have to Pay)

Desire leads to Greed / Impulse Spending

Example: You impulse spend on small “convenience” purchases like fast food or unnecessary upgrades, and later realize you’ve eaten into cash flow that could’ve gone to scaling your business.

Money Saving Takeaway: Before spending, ask “Does this actually create revenue?” If not, wait 24 hours before buying.

Fear leads to Avoidance / Cowardice

Example: You hear rumors of risk, back out of a promising deal too early, and watch competitors scoop up the profits you left on the table.

Money Saving Takeaway: Replace “What if I lose?” with “What will I lose if I don’t try?” Fear often costs more than failure.

Anger leads to Wrath

Example 1: You lash out at a customer over a dispute and lose their business.

Example 2: In negotiations, your reputation for outbursts makes corporate partners label you as “difficult,” cutting you out of future opportunities.

Money Saving Takeaway: Step away before responding. A single angry email or rant can cost tens of thousands in lost business.

Insecurity leads to Envy

Example: You see a competitor make a big move, so you buy things you can’t afford just to keep up, draining money you actually needed.

Money Saving Takeaway: Instead of focusing on the competition, focus on doing what keeps your customers happy and loyal.

Boredom leads to Sloth

Example: You plan to make sales calls but end up scrolling on your phone for hours and pushing off work that actually gets you paid.

Money Saving Takeaway: Build a “money task list” and write three revenue-related actions you HAVE TO finish before checking off anything else.

Curiosity leads to Gluttony (for info)

Example: You spend hours researching minor topics or chasing endless new “workflows” instead of focusing on the tasks that actually grow your business.

Money Saving Takeaway: Limit research time to one hour per week. The rest of the week, stick to executing your “money task list”.

Worry leads to Envy / Pride

Example: You vent in the wrong place, take advice from the wrong people, and end up sabotaging your own business plan.

Money Saving Takeaway: Only seek advice from people who’ve achieved what you want, then filter out everyone else.

Lesson 3: Don’t Let Emotions Run Your Business Decisions

Danger doesn't always come from things outside of your business. More than that, it comes from the times your emotions make decisions for you. That’s when reckless spending, bad exits, or ego driven moves can cost you more than competitors ever could.

So how do you get around this issue? By treating your emotions like friends trying to wave you down from across the street. If you ignore them or misread what they’re saying, you’ll end up in a bad situation. But if you actually listen, they can help you make the right move in the moment.

Lesson 4: Treat Your Emotions Like Friends With Warnings

Every emotion you feel is a signal telling you how you’re spending your attention right now. If you train yourself to pause and “hear them out,” you can use that signal to respond in a way that protects your money, time, and focus.

That’s where the “Heat Check” comes in. It's a game plan that flips an emotion from a trap to an advantage. You hear what your “friend”(the emotion) is saying, respond with the action that matches it, and then move ahead without feeding the sin it could lead to.

Lesson 5: The Heat Check – How to Use Each Emotion

Boredom → “It’s telling me I’m currently living in a zone of comfort.”

Quick Response: Ask, “If it didn’t have a negative short-term outcome, what would I be doing right now?” List the true long-term benefits until your focus is only on those. If you can’t find enough to justify it, don’t do it. If you can, be like Nike and just do it.

Desire → “It’s telling me that my attention is on something that's pleasurable in the short-term”

Quick Response: Ask, “What’s the long-term consequence of doing this?” If the long term outcome is good, do it if you still want to. But if not, take a few deep breaths and let the thought go.

Tired → “It’s telling me I need to spend more attention on my mental or physical health.”

Quick Response: Take a nap, then go to bed early tonight.

Worry → “It’s telling me that my attention is on something that isn’t in my control.”

Quick Response: Ask, “What’s in my control in this situation?” Focus only on that. If you can do something now, do it. If not, take a few deep breaths and let the thought go.

Insecurity → “It’s telling me that I’m looking to something outside of myself & the truth for security.”

Quick Response: Apologize (in your mind) for trying to control others for your own sense of security socially, emotionally, physically, or financially. Then identify what you feel insecure about, and respond using the “worry” process above, swapping the word “worry” for “insecurity.”

Fear → “I’m moving towards something that might be rewarding if I overcome the fear.”

Quick Response: Take a few deep breaths and say, “That’s not fear, that’s just high energy. I’m excited.” Then ask, “What’s the opportunity in this situation to be grateful for?” Focus on that.

Stress → “It’s telling me that my attention is on worry about the past or what hasn’t happened yet, not the present.”

Quick Response: Say, “Thank you for the moment I’m in right now,” and list or say out loud reasons you’re grateful for it.

Anger / Frustration / Pain → “It’s telling me I’m at an opportunity for progress.”

Quick Response: Ask, “What’s the opportunity in this situation to be grateful for?” Focus on that, even if you need to think about the long-term(how things will be months or years from now) to find it.

Lesson 6: Turning Emotion Into Leverage

The difference between losing money to sin and using emotion as a weapon is just one pause and one smart response. Your emotions aren’t enemies. They’re the early warning system for your attention, your wallet, and your reputation. If you start treating them like friends with good intel, you stop being the person who gets baited…and start being the person who can’t be played.