The #1 Secret for Unlimited Opportunities in the Stock Market

How Emotions Lead to Huge Gains in Stocks

Life is like a vending machine, and opportunities in life are like being handed a dollar.

Inside that machine are your desires, your goals, and everything else you want in life. The catch? Just like a real vending machine, you HAVE to feed the dollar in the right way for it to be accepted.

Every situation you come across in life is like that dollar. One side of it represents problems, and the other side represents an opportunity. If you put it in the wrong way(only seeing problems) then the machine spits it back out no matter how many times you try. But if you line it up correctly(choosing to see the opportunity), the machine accepts it and you get what you want.

And just like with real money, if you wait around for someone else to hand you a dollar every time you want something, you’ll be broke pretty fast. Eventually you have to learn how to create and attract more for yourself.

The good news is that life will keep giving you “dollars” through different situations. But it’s always up to YOU to put them in the machine the right way.

Fear and Greed as Open Doors

Up until now, we’ve talked about pain and desire as the two big signs of opportunity. But there are two more emotions that work as “dollars“ for the vending machine we call life: fear and greed.

When you learn to spot these two emotions, it’s like getting a $5 instead of a $1. The rest of this post will explain why.

Step 6: Learn The Emotions Behind Every Technology

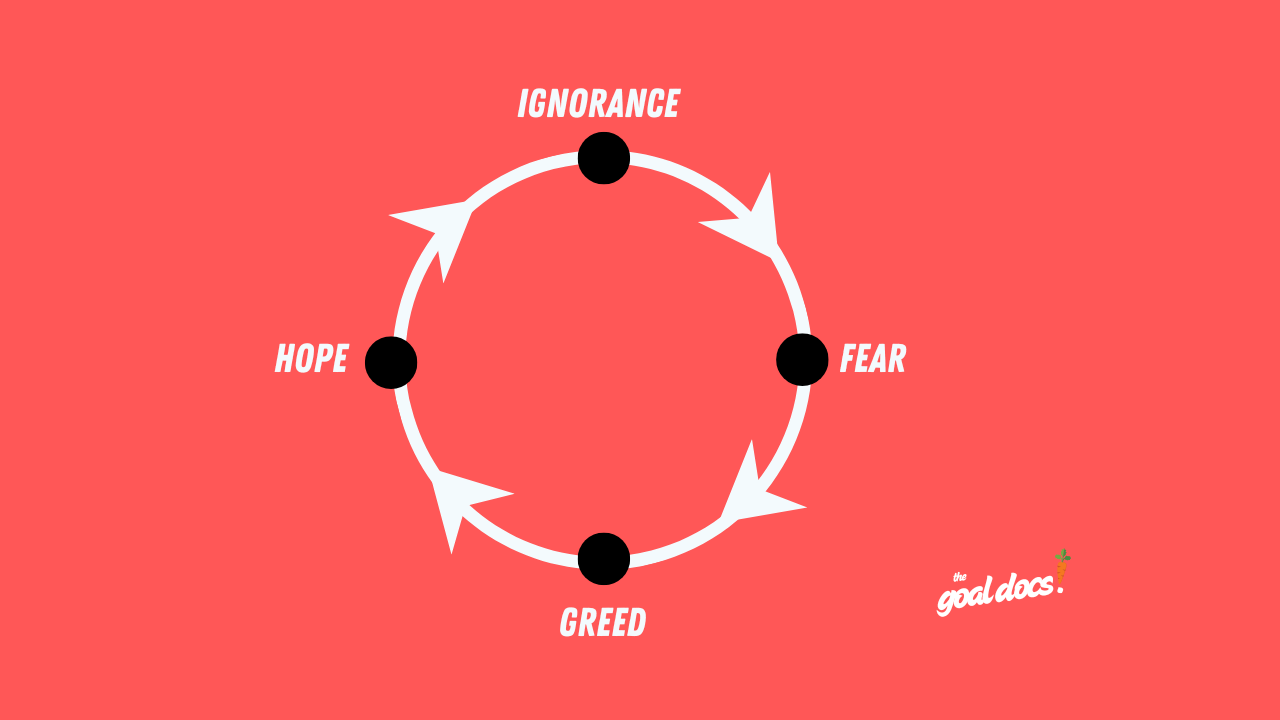

Throughout history, every new technology or industry goes through the same emotional cycle: Ignorance → Fear → Greed → Hope → and then back to Fear and Greed. Here’s how the cycle works:

The Ignorance Stage — “What Even Is This?” At first, people might have heard of the thing but don’t really understand it. It sounds too weird or too far from reality to matter. This is when people who are ahead of the curve are learning and investing early while everybody else is looking it over or just haven’t even heard of it.

The Fear Stage — “This Will Ruin Everything.” Eventually, people will start paying attention. But when the attention grows, so does panic. The technology/industry is still new at this point, and people tend to fear what they don’t understand. So the headlines you will see here are things like “It’s a scam,” “It’ll take jobs,” “It’s unsafe.” But for the people who were doing their homework, fear from the crowd means discounted prices, less competition, and a rare opportunities while everyone else is freezing.

The Greed Stage — “Everybody’s Getting Rich!” Next, someone will figure out how to make money from the thing(usually through a stock or something similar). At this point, people forget their fears because all they can see are dollar signs💲💲. So seemingly EVERYONE starts to jump in and chase the hype because they don’t want to miss out(not because they understand the value). All this greed creates companies that are overvalued because they attached their names to a trending technology or industry, not because they were good at actually creating any value. The opportunity at this stage is short-term, risky, and overpriced.

The Hope Stage — “It’ll Come Back.” Eventually, reality sets in. Many companies that were just good at marketing their connection to the trend start failing, while the truly valuable ones survive low key and in the background. Prices drop, the hype fades, and people who got in late start clinging to hope that “it’ll rebound soon” or “it’ll reach 5x the all time high”. That’s the setup for the final emotional turn, going back to fear.

Back to Fear — “It’s Dead.” Once everyone’s hope is ruined😞, fear takes over again. To make things worse, the fear gets amplified by big headlines about people losing fortunes, and the same public that once bragged about being early now avoids the entire space. But this moment of collective fear is also when the cycle restarts — it sparks curiosity in people who were previously ignorant, starting the loop all over again.

I was born in the late 1990s and I was very young when some of the industries over the last 30 years were going through this cycle. So I used ai to give a description of how industries have gone through the cycle:

The Internet (1990s–2000s)

Ignorance: Early 90s, most people said the internet was a “nerdy fad.” Companies didn’t see the point of having websites.

Fear: Late 90s, skeptics warned about “dot-com scams,” and many big investors stayed out.

Greed: 1998–2000, dot-com bubble, everyone wanted a website stock. Pets.com, etc.

Hope: 2000–2002, after the crash, people held onto dead dot coms, hoping they would bounce back.

Back to Fear: Early 2000s, investors swore off internet stocks. But under the surface, Amazon, Google, and eBay were building real businesses.

Housing Market (2000s)

Ignorance: 2000–2003, most people didn’t understand subprime mortgages.

Fear: Early warnings (2004–2006) about risky lending were ignored, but some insiders saw the dangers on the way.

Greed: 2006–2007, everyone wanted a house, and everyone thought “housing never goes down.” Flipping homes was the hot thing.

Hope: 2008 crash, homeowners and banks held onto dying assets, hoping they’d come back.

Back to Fear: 2009–2012, mass fear around housing led to people avoiding real estate.

Bitcoin & Crypto (2009–2025)

Ignorance: 2009–2012, almost nobody understood Bitcoin. Dismissed as “internet money for nerds.”

Fear: 2013–2015, labeled “drug money” or “Ponzi scheme.” Governments cracked down, big hacks scared investors.

Greed: 2017 & 2021 price runs. Bitcoin became mainstream, everyone is buying coins and NFTs.

Hope: 2018, 2022 crashes, people held onto dying tokens and NFTs saying “the next bull run will save us.”

Back to Fear: After each crash, people swore off crypto, saying “never again.” But people who researched solid projects (BTC, ETH) and bought during fear rode the next wave up.

Artificial Intelligence (2015-2024)

Ignorance: Pre-2015, AI was “sci-fi” for most people, not something they thought would touch daily life.

Fear: 2015–2023, headlines saying “AI will take your job,” “AI is dangerous,” or “AI will replace humans.”

Greed: 2023–2024, sudden AI gold rush. Startups raising billions, investors piling in, businesses slapping “AI” on everything.

Hope: Some overhyped projects (AI coins, “AI everything” companies) are already crashing, but people are still holding, hoping they’ll turn around.

NFTs (2020–2022)

Ignorance: 2020, most people didn’t even know what NFTs were.

Fear: Early skepticism — “worthless jpegs.”

Greed: 2021 boom — Beeple sells for $69M, bored apes at $400k. Everyone piles in.

Hope: 2022 crash — holders said “they’ll come back” as floor prices collapsed.

Back to Fear: 2023–2024, most people swore off NFTs.

Step 7: So What’s The Opportunity?

Now that you know how technologies and industries go through a predictable and emotional cycle, how do you use this to find opportunities? Easy:

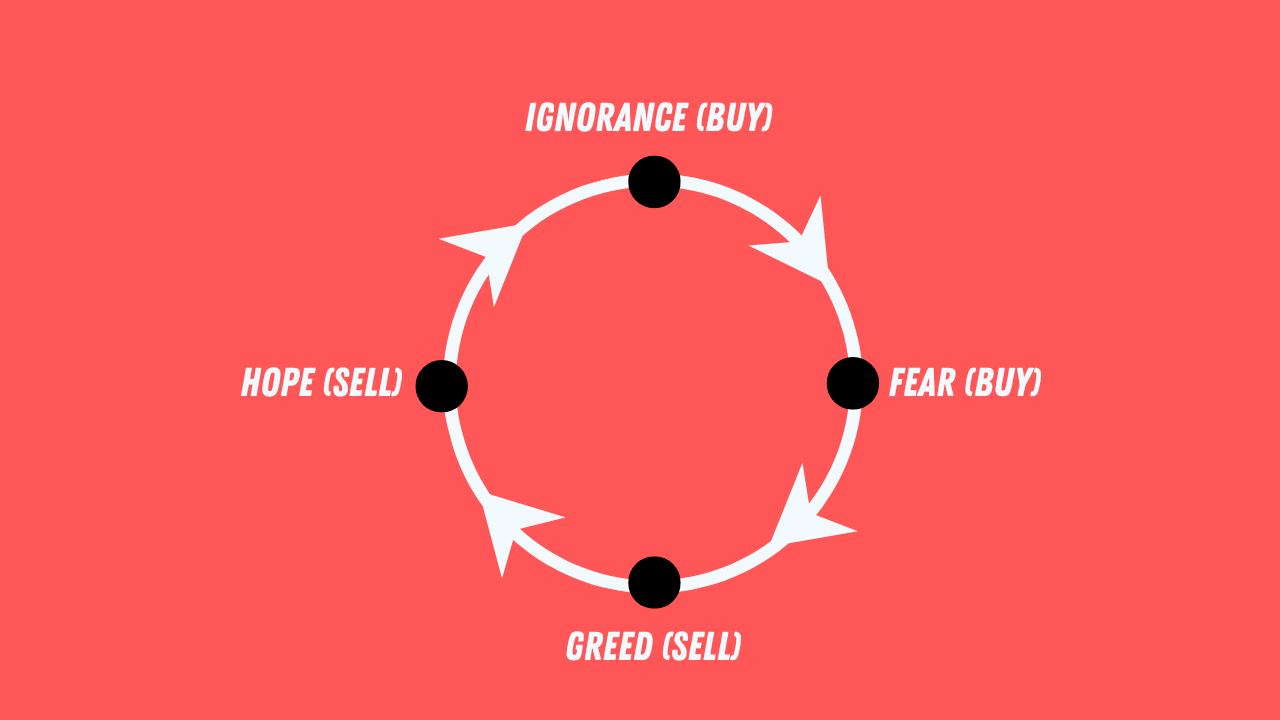

When you hear other people speaking about a technology or industry and the discussion is based in ignorance or fear, it might be a great opportunity to buy.

But when you hear other people speaking about a technology or industry and the discussion is based is greed or financial hope, it’s probably a good time to either sell or hold off on buying.

And “buying” doesn’t just mean putting your money into a stock. If you want to profit from an industry or technology that’s being undervalued, you can also do it by:

working at a company in the growing industry

starting a business of your own in the growing industry.

None of the 3 options are necessarily easy, but they’re at least options that are available.

Step 8: Pay Attention To Speed

Earlier I gave examples of different technologies that have gone through the emotional cycle starting with the internet in the early 1990s. Notice the timelines of how long it took each technology to go through the cycle:

The Internet (1990s–2000s)

Bitcoin & Crypto (2009–2025)

Artificial Intelligence (2015-2024)

NFTs (2020–2022)

What’s the theme? Each newer technology goes through the cycle in a shorter timeline than the older one. It took the internet around 10 years to go through the cycle, but only 2 or 3 years for NFTs.

HOWEVER, while these industries don’t go through the initial cycle of ignorance to fear to greed and then hope at the same speed, they do oddly go from

the 2nd fear stage - where there’s huge discounts after everyone has lost hope

to

the 2nd greed stage - where companies like Amazon and eBay after the dot com bubble went from all time lows to their actual values

in the same time frame. Here’s ai again to explain:

Internet / Dot-Com

2nd Fear Stage: 2001–2003. Internet stocks dead, dot-com bust.

Return of Greed: ~2006–2007 (Google IPO in 2004, Facebook scaling mid-2000s, YouTube boom). By the late 2000s, social media + streaming drove a new hype cycle.

Window Length: ~3–5 years of “cheap” fear before hype fully came back.

Housing Market

2nd Fear: 2008–2012. Foreclosures, people swore off housing.

Return of Greed: 2013–2016, investors and regular buyers piled back in, home prices rising fast. By 2016, FOMO was back in hot markets.

Window Length: ~4–5 years of fear before greed returned.

Crypto / Bitcoin

2nd Fear Stage: 2018–2019 (after the 2017 run crashed). Again in 2022–2023 after NFTs + meme coins blew up.

Return of Greed: 2020–2021 spike in price, and another bull run is happening in 2025.

Window Length: ~2–3 years. Crypto cycles are faster than traditional industries.

Artificial intelligence and NFTs are too new as mainstream technologies for me to say when they went from the 2nd fear stage(high discounts) to the 2nd greed stage(high payoffs). But observing the internet, housing, bitcoin, and other industries that I didn’t include in this blog post for the sake of length, it seems pretty consistent that it takes 2-5 years for a technology to go from being highly discounted(2nd fear stage) to being hyped and overpriced again(2nd greed stage).

With all of this said, I am not a financial advisor, nor am I an investing coach. I just like learning about emotions and human nature, and I found something cool that’s worth sharing. So if you decide to take the opportunity of investing in a technology or industry that may emerge in the next 2-5 years, I highly suggest speaking to a financial advisor or investing coach to pick the best strategy for yourself.

Here are the technologies or industries that I observe to be in the 2nd fear stage(big discounts) in Q4 of 2025.

NFTs - Greed (2021) → Hope (2022) → Fear (2023–now)

Metaverse / VR - Greed (2021–2022) → Hope (2022–2023) → Fear (2023–now)

Green Energy / Solar - Greed (2020–2021) → Hope (2022) → Fear (2023–now)

Biotech - Greed (2020–2021) → Hope (2022) → Fear (2023–now)

Here are the technologies or industries that I observe to be in the greed stage(maybe overpriced/overhyped) in Q4 of 2025.

Gold - Fear (2008–2011) → Greed (2011 peak) → Greed (2020–now1)

AI - Ignorance (pre-2015) → Fear (2015–2022) → Greed (2023–now)